President Biden has signed the Inflation Reduction Act into law. This act includes some excellent incentives for residential new construction that are guaranteed to save energy and prepare residences to become zero energy structures. The first thing this portion of the act does is to extend the 45L tax credit through the end of 2022. It had expired at the end of 2021. This provides the ability for builders and developer who have been building and selling energy efficient structures this year to claim their credits for that work.

Historically, the 45L tax credit has been extended on an annual, and retroactive basis, which has been a headache for builders, developers, accounting firms, and the energy professionals who verify qualifying structures. The second thing this act does is to update and extend the tax credit for nine additional years through the end of 2032. One can almost hear the huge sigh of relief from all these stakeholders.

The 45L tax credit has also historically used stand-alone verification criteria that were different from any other energy efficiency program. The third thing this act does is to align qualification for the tax credit with well-known and well-vetted programs. It provides credits based on qualification or certification under EPA ENERGY STAR and DOE energy programs. Starting in 2023 builders will need to ensure their structures qualify for ENERGY STAR certification or achieve Zero Energy Ready Home certification. The amount of the tax credit provided differs based on which of these is achieved as well as whether prevailing wages have been paid on the project.

There is a subtlety to the requirements that is important to understand. At the lower tiers of tax credit amount, the act requires “qualification” for the ENERGY STAR program being used: the ENERGY STAR New Homes Certification Program, the ENERGY STAR Manufactured Homes Program, or the ENERGY STAR Multifamily New Construction Program. However, at the upper tiers of tax credit, the act requires “certification” for the DOE Zero Energy Ready Home (ZERH) Program. This also requires certification for the applicable ENERGY STAR program because that certification is required under the ZERH program. Make no mistake, qualifying vs. certifying does not provide any shortcuts, because the ENERGY STAR programs make it very clear that to “qualify” for their programs, builders, developers, HVAC technicians, verifiers, and others must still meet all requirements. This includes training and credentialing of those involved in the project, and all the checklists and verifications would still need to be performed to verify the qualification to the IRS. Jumping through the hoops to meet all the requirements and stopping short of actual certification might save a few dollars, but that also eliminates the marketing and support the program provides. Following through with the process will reap dividends that far outweigh the up-front cost of certification.

The act also changes this tax credit to make it applicable to all multifamily developments regardless of height. This fourth change will provide an increase in jobs for the verification teams and incentives for builders and developers. This is work that must be performed in-person so these additional jobs will remain in America.

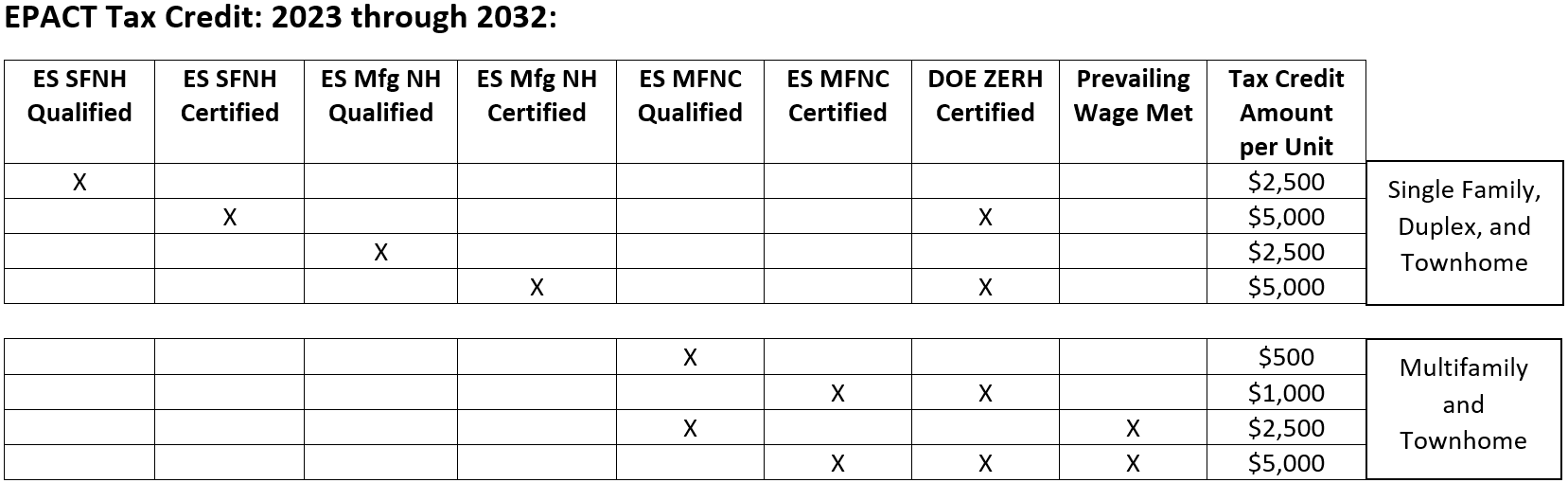

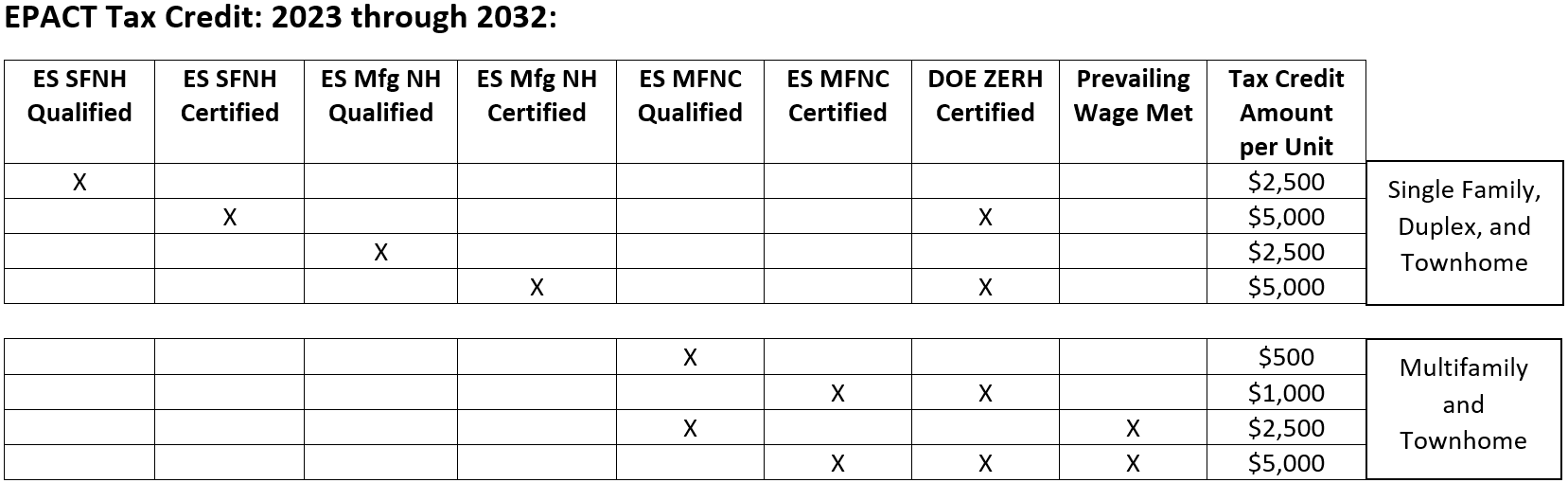

The fifth thing this act does is to increase the 45L Tax Credit. The first tier of credit is $2,500 per home or $500 per apartment in multifamily construction and the second tier of credit is $5,000 per home or $1,000 per apartment. The apartment numbers increase to the $2,500 or $5,000 level per unit if prevailing wages are paid for those projects. The table below summarizes the requirements and tax credit levels.

Overall, this update to the 45L Energy Efficiency Tax Credit is a significant expansion in scope and participation. It promises American jobs with living wages along with major incentives to build energy efficient homes for the next ten years.

ES SFNH = ENERGY STAR Single Family New Homes Program

ES Mfg NH = ENERGY STAR Manufactured New Homes Program

ES MFNC = ENERGY STAR Multifamily New Construction Program

DOE ZERH = DOE Zero Energy Ready Home Program

Qualified = Meets the requirements of the applicable program (doesn’t have to be certified, but if it is Certified it is considered Qualified)

Certified = Certified under the applicable program

Link to ENERGY STAR Online On-Demand Training and Certification: https://energysmartinstitute.com/esv3-training-info/

Link to Home Energy Rater (HERS*) Rater Certification Online On-Demand Training: https://energysmartinstitute.com/resnet-hers-rater/

Link to HERS Modeler Certification Training: https://energysmartinstitute.com/hers-modeler-certification/

Link to Recommended Rating Field Inspector (RFI) Training: https://energysmartinstitute.com/recommended-rfi-courses/

EnergySmart Institute Course Catalog: https://energysmartinstitute.com/course-catalog/

*HERS = Home Energy Rating Systems